Financial education for the old age protection.

Description

Periodical Economic Benefits, BEPS, is a voluntary saving program, designed to protect people whose resources are not enough to contribute to a pension. People who save in BEPS, build the capital that will allow them to enjoy a lifelong income in retirement. Financial education BEPS tools are designed and implemented to get beneficiaries closer to retirement saving schemes to reduce economic risk in old age, contributing to schemes that seek to increase resistance to social vulnerabilities inherent at this life stage

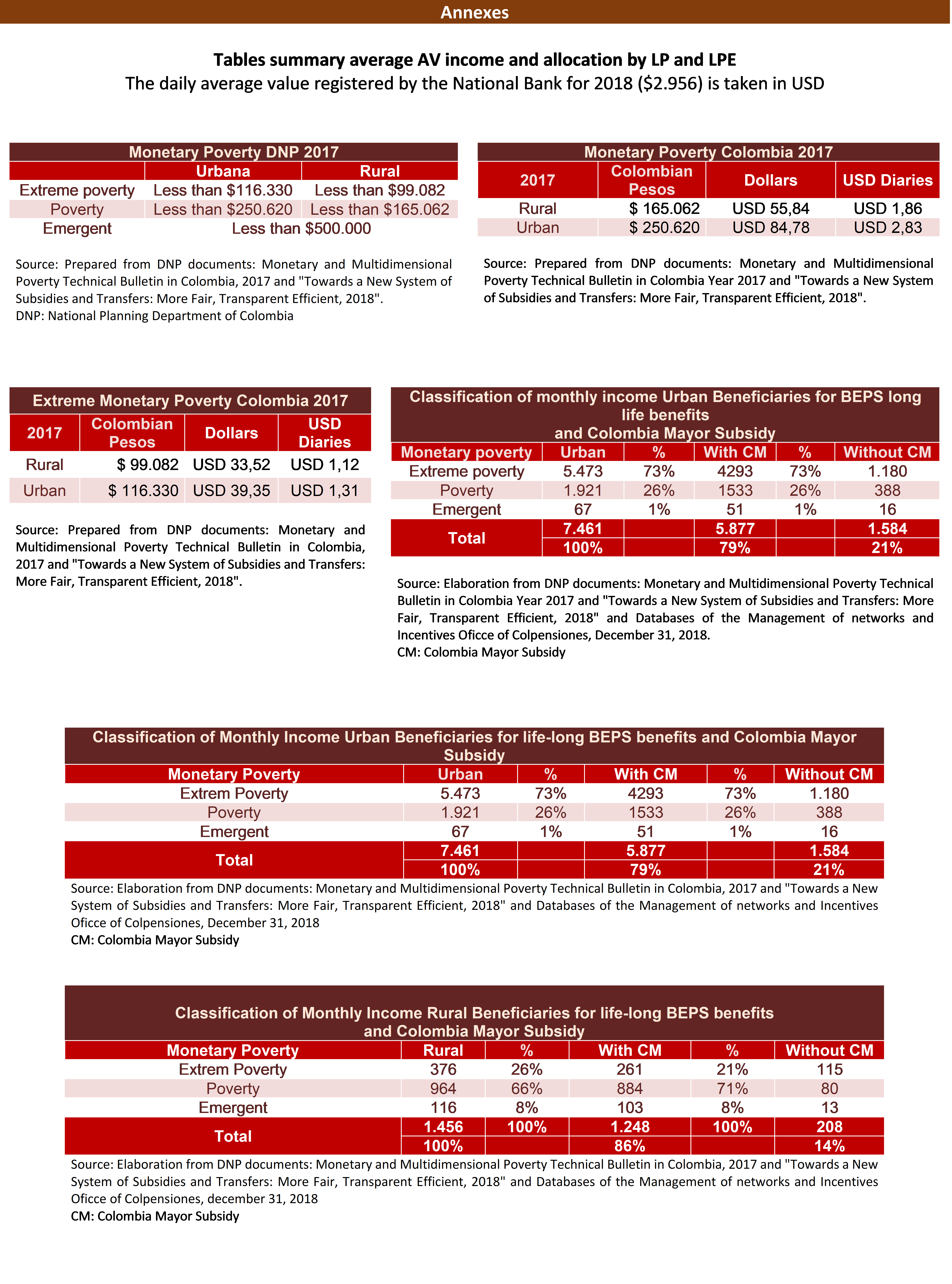

Population projections from the National Planning Department of Colombia, asserts that population pyramid will be modified towards a high percentage of adults 60 years or older, moving from 14.3% (2017) to 23% (2050), which means a greater effort to ensure economic protection programs for the ageing population, especially because people who contribute to pensions, only represent 41% of all members of the system and just 1 out of 3 will be able to retire. Studies* show that 30% of colombian population, 60 years or older, continues working, in contrast to 11.1% on average of european countries, a situation that gets worse if it is considered the chances of accessing to formal employment is reduced with age by 23%, and just 57% of economically active population with secondary education get a job and get an income between 0.5 and 1.5 monthly minimum wage** With financial education BEPS tools, implemented since 2015, 8,917 life-long benefits have been delivered and 7.125 subsidies for seniors have been arranged, which allows beneficiaries to receive monthly average incomes of $ 127.000 Colombian pesos approximately, this is, 42.56 USD per month*** and USD 1.42 per day, this income levels contribute to overcome the extreme monetary poverty of this population in Colombia****. From Urban population that is beneficiary, 73% of them is registered with income below the extreme poverty, this means 5.473 adults over 60 years old with life-long benefits below 39.33 USD and 1.31 USD daily, 79% of them are leveraged with the Colombia Mayor subsidy (an additional state subsidy for vulnerable and poor older people), while similar income to the poverty line is 26% with 84.78 USD per month and 2.83 USD per day. 1% has managed to overcome monetary poverty, locating it in the category of emerging income. From Rural beneficiary population, 66% receive income below the monetary poverty line, 55.84 USD per month, 1.86 USD per day; there are 964 seniors with incomes below extreme monetary poverty line with 33.52 USD per month or 1.12 USD per day, which 86% are leveraged with the Colombia Mayor subsidy. Rural population who receives a BEPS life-long benefit below the extreme poverty line account for 26%, less than 39.35 USD monthly and 1.31 USD per day, while 8% have managed to exceed this income, located themselves on the emerging income category with more than 85 USD per month. BEPS program has gradually gain on challenges of pension savings and has implemented financial education strategies that allow beneficiaries to receive life-long benefits that exceed 34 USD per month, applying tools and advisory schemes that bring down savings barriers, which are stronger in promoting pension savings, which more than 400.000 beneficiaries are participating in BEPS program. * Fedesarrollo and Fundación Saldarriaga Concha. (2015). Mission Colombia Aging, figures, challenges and recommendations. ** DANE. (2017). Labor force and education Technical Bulletin. *** TRM used corresponds to the 2018 average, calculated on the historical journal published by the National Bank. **** Monetary and multidimensional Poverty in Colombia 2017

Culture of saving has been built in this program, it considers habits and conditions of environment of citizens, and so that in BEPS they obtain a sufficient economic reserve which can protect them in the old age. For that, it has been proposed to overthrow saving barriers and promote habits and behaviors that generate positive attitudes and motivate everyone to save for old age:

1. We save for all life stages.

2. We are ready to a happy and protected old age.

3. We save for old age protection, to give security to our families.

4. We save because we want.

5. We build the future between all.

Advice in BEPS, recognizes in beneficiaries’ attitudes and beliefs against savings for old age, and aims to mobilize feelings and emotions, to bring down barriers to saving for old age and encourages the savings habit through a plan. It was implemented in two main scenarios:

Advice to promote saving habits through a plan: it was implemented with support of eight BEPS managers and Colpensiones. From 5.876 beneficiaries, 2.834 do not had retirement age and 3.042 had it. After citizen advice, 46% of them developed a saving plan in BEPS, it noted greater interest and participation of people without retirement age.

From 2.676 agreed plans, 58% improved savings in BEPS and 32% met or exceeded the agreed plan, this result validated this strategy to promote a culture of saving for old age and highlighted its potential to generate resistances in people to face economic risks by allowing them to receive incomes that exceeds the levels of poverty and extreme poverty of this population. In 2019, this practice will be extended to all care network and the goal is to generate more than 100.000 savings plans and more than 5.000 life-long benefits.

Ambassadors of savings BEPS: This strategy was implemented with support of tjhe work team of Colpensiones and their regional offices. It allows to linked BEPS person could be an ambassador, who mobilize the savings behavior of their relatives. Each ambassador received advice and savings workshop in 2018, savings culture was strengthened and information and benefits of BEPS program were broadened.

Today, there are 2.331 ambassadors who mobilized the own savings and referrals, who saved more than 272 million pesos in 2018. Those linked persons between 50 and 60 years old were the most interested (48% of those registered), compared to 40 and 49 years old (23%) and 60 to 69 years old (17%). In turn, Colpensiones delivered an incentive to those who increased the savings of their referrals in certain ceilings; it was paid through the individual BEPS savings account .

Both practices required financial education tools, designed to promote retirement savings, and applied in controlled environments where contents and methodologies were validated.

- Strengthen competences of BEPS managers. Gradually it has progress in strengthening competencies of 170 BEPS managers of the Colpensiones service network throughout the country, applying experiential learning methodologies and made content to virtual environments that reinforce and motivate those who advise and operate the BEPS program.

- Reprogram goals and actions to comply with, directing efforts, extending other assistance channels to the advisory scheme in BEPS savings plan. Self-assess results achieved and strategies applied for the promotion of the savings culture in BEPS, strengthening the service channels with the citizens and providing advice based on the needs and opportunities of beneficiaries.

- Manage resources to strengthen savings in the BEPS program and increase the saving culture. Participate in the Public Policy scenarios with results and proposals, according to the objective of promoting in population, habits of planning and savings related to social security schemes and protection to old age, as well as the promotion of BEPS in the context of corporate social responsibility programs.

Data valid up to December 31, 2018, 459.833 savers have been registered, which are people who have had the intention of saving to protect their old age. Comparing the participation of BEPS savers in cities that, according to the DANE, register higher rates of monetary poverty and that would correspond to the places where resistance is more due to the economic risks of old age, it is found that 40% of them live in some of the 23 classified cities.

The challenge is enormous and the barriers that Colpensiones has identified for savings are added to the difficulties faced by relatives of elderly in poverty. That is why is urgent to carry out actions that allow pension savings to be an option in medium and short term, allowing old people to access a complementary protection scheme like BEPS.

As such, the chances of replicating promotion schemes of the saving culture practiced the last year, improving the benefits and the opportunity of more and more Colombians people can provide an income for elderly, besides contributing to eradicated extreme poverty and generate resistance in most vulnerable population, so that the economic risk that comes with old age is more likely to be assumed.

The mentioned practices for promotion of saving culture allowed:<br />

<br />

Strengthen the participants commitment to save in BEPS, motivated by vulnerabilities and economic risks that they can be exposed in old age. Thanks to this situation, their decision to save in BEPS was strengthened and their exposure to this kind of vulnerabilities and risks was reduced.<br />

<br />

Develop skills and abilities in the strengthened ambassadors, who build up their knowledge in financial education and obtained needed tools to orient their relatives circle about opportunities offered by the BEPS program and invite them to save for protection of their own old age.<br />

<br />

Stimulate savings and confidence behavior in this programmed, thanks to the spaces generated to recognize their effort to protect people in BEPS and to know their concerns and be heard; these are key elements to facilitate the promotion of culture of savings in BEPS and ensure the chances of receiving a long-life income in this stage of life.<br />

<br />

Promote saving habits as the first step to bring down cultural and social barriers associated with retirement savings and encourage participants to assume a positive attitude in a saving culture for old age in BEPS. Thanks to these habits, their savings today have a purpose and they are intentionally prepare themselves to live a happy and protected old age.<br />

<br />

Promote the use of savings channels arranged by Colpensiones, socialized their advantages, increased the collection and positioned savings for old age as a planned expense within the family finances.<br />

<br />

Positioning the BEPS ambassadors, who now transmit to the community and relatives their experience and information to save for protection in old age. Today, they are part of a scheme that encourages personal and family to have own savings and be the vehicle to prioritize this item within family finances.<br />

<br />

Design tools for promotion of savings based on citizen’s needs, considering their own capabilities, based on studies and research that Colpensiones made to ensure the most appropriate approaches and languages for these processes. <br />

<br />

Promote programs that the Colombian State is pursuing, aimed at protecting the elderly of the most vulnerable citizens and those who did not meet the requirements to have a pension, informing them that they are not alone in this effort, as well as advising them, so that they can access this option and can receive the benefits of the BEPS program.

https://www.colpensiones.gov.co/beps/index.php

Featured videos

• BEPS. Plan B for old age

• BEPS. What makes BEPS different?

• BEPS. Who can be linked?

On YouTube channel: https://www.youtube.com/channel/UClOp5Pa8fgBDwrUL0H3PeNg

Internal audit reports for years in:

https://www.colpensiones.gov.co/Documentos/reportes_de_control_interno

Management reports for years (2013 - 2017) in:

https://www.colpensiones.gov.co/Documentos/informes_de_gestion

SDGS & Targets

Deliverables & Timeline

Resources mobilized

Partnership Progress

| Name | Description |

|---|

Feedback

Action Network

Timeline

Entity

SDGs

Region

- Latin America and the Caribbean

Geographical coverage

Photos

Website/More information

Countries

Contact Information

Carolina Franco Lasso, Master Professional